🏆 THIS IS NOT JUST ANOTHER EA 🏆

This is a Premium bot with ML Auto Risk Management and DrawDown Control Mechanism

This is the real one every traders wants

EVERY TRADERS DREAM ✓ Being Profitable and Emotions-FREE✓ Trading Discipline with Confidence

✓ Scalable = Stick with Strategy

✓ Let the System Trade 24×7 While You Sleep or

Doing Your Regular Job/Routines

🎯 Core Philosophy

This EA intentionally avoids ALL common retail trading concepts.

- No Martingale

- No Grid

- No Netting

- No HFT (High-Frequency Trading)

- No Indicators (MA, RSI, Bands, Oscillators, etc.)

- No Price Action patterns

- No SMT or correlation dependency

⚙️ MARKET CONDITIONS — IT DOESN'T CARE

The EA performs consistently regardless of market type:

🧠 The Algorithm Reacts to Market BEHAVIOR, Not Market LABELS

Unlike traditional systems that categorize markets into "trending" or "ranging," this EA responds to the underlying mathematical patterns and probability shifts in real-time.

🚫 WHAT THIS EA DOES NOT DEPENDS ON

- No candle close confirmation

- No timeframe dependency

- No high-impact news avoidance

- No red-folder news filter

- No indicator calculation delay

- No manual market analysis

- No session-based trading logic

Once attached to your chart, the EA handles everything automatically — 24×7.

🔒 Advanced Risk & Drawdown Control

Risk management is the core strength of this EA.

Adaptive Machine Learning Risk Engine

User defines initial risk (10% preferred). After trade entry, the Smart ML engine continuously re-evaluates market behavior and automatically reduces risk exposure to:

➡ This mechanism significantly limits extreme drawdowns while keeping growth potential intact.

Win Rate Trade-Off (Intentional Design)

Raw strategy win rate: ~92%

With full protection enabled: ~80%

The reduced win rate is intentional and designed to maximize capital safety during unstable market conditions. The EA sacrifices some winning trades to prevent catastrophic losses.

📌 Understanding the 10% Risk Setting

Important Clarification

10% risk means a 10% loss ONLY if the initial stop-loss is fully hit. It does not mean 10% loss on every losing trade and does not imply 10% account risk (win rate is 90% and never hit full SL so it handles 20% risk usually, meaning 10% is still conservative).

The EA does not continuously risk full 10%. Risk is dynamically reduced within seconds or minutes after trade entry through the ML protection system.

📊 Historical Data:

In the last 5 years, a full 10% loss occurred only once:

Date: Jan-11-2024

Time: 15:30–15:31 (ICMarkets server time)

Reason: Abnormal market gap

📊 Trading Style & Frequency

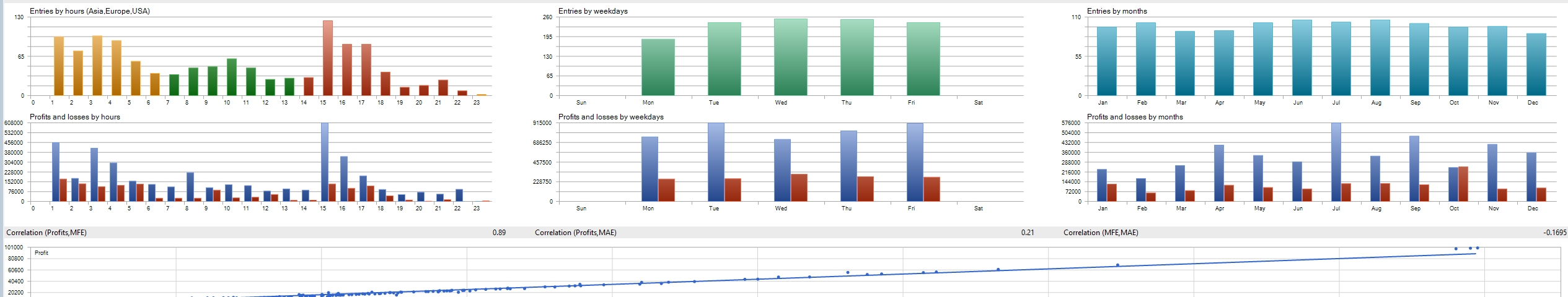

📈 Performance Evidence (Real Market Backtests)

All results below are carefully backtested in real-market conditions including true ECN spreads, commissions ($7/lot), realistic execution delay (100ms), and without optimization or curve fitting.

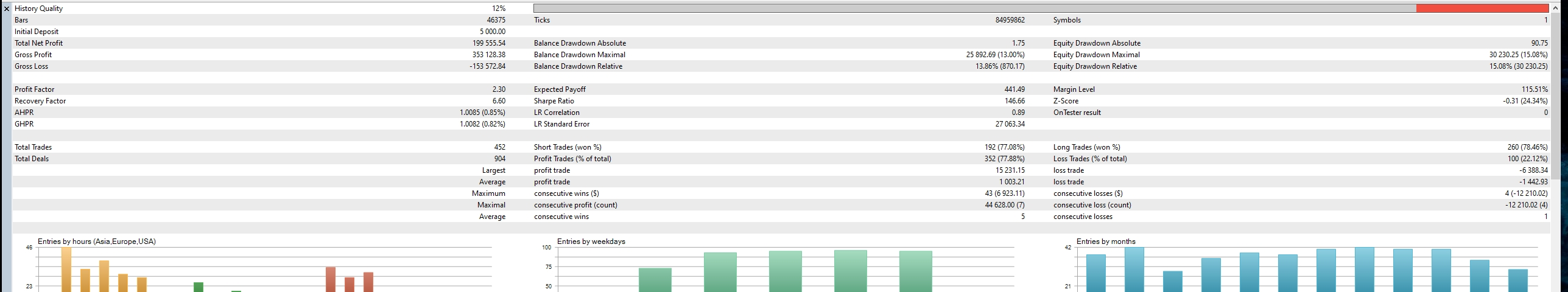

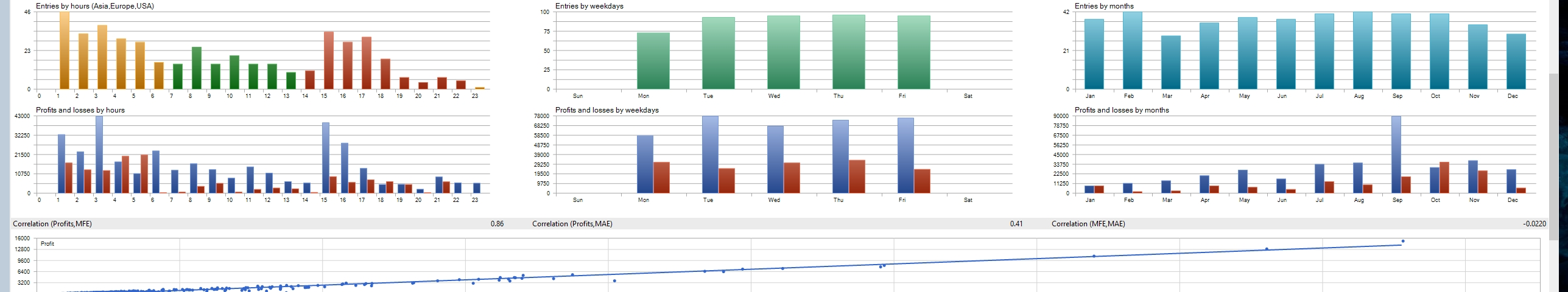

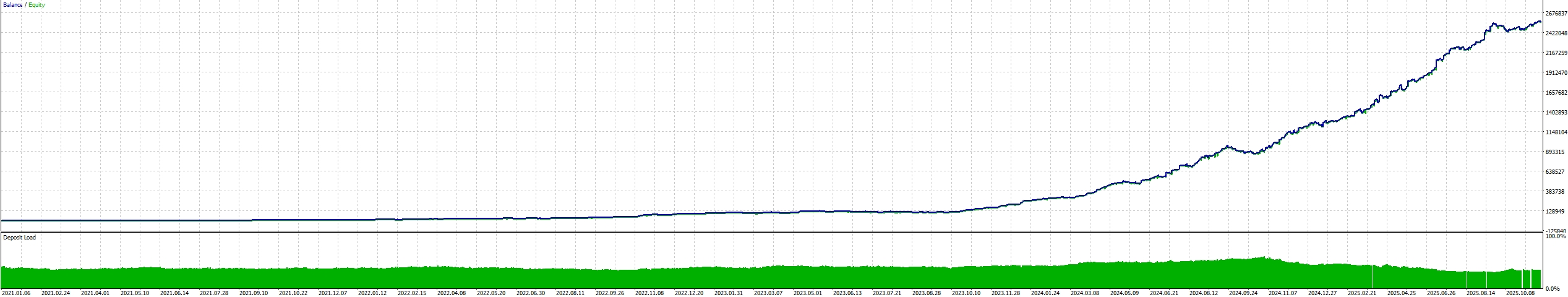

📊 Key Metrics to Observe: Initial Balance, Net Profit, Balance DD Maximal, Recovery Factor, Profit Factor, Sharpe Ratio, Total Trades, Win %, Consecutive Wins & Losses

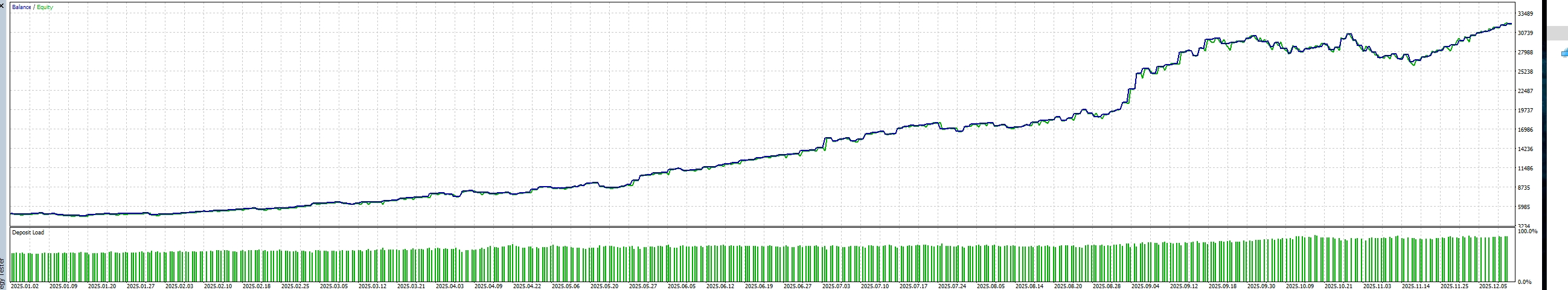

📊 2025 Performance (Last Year)

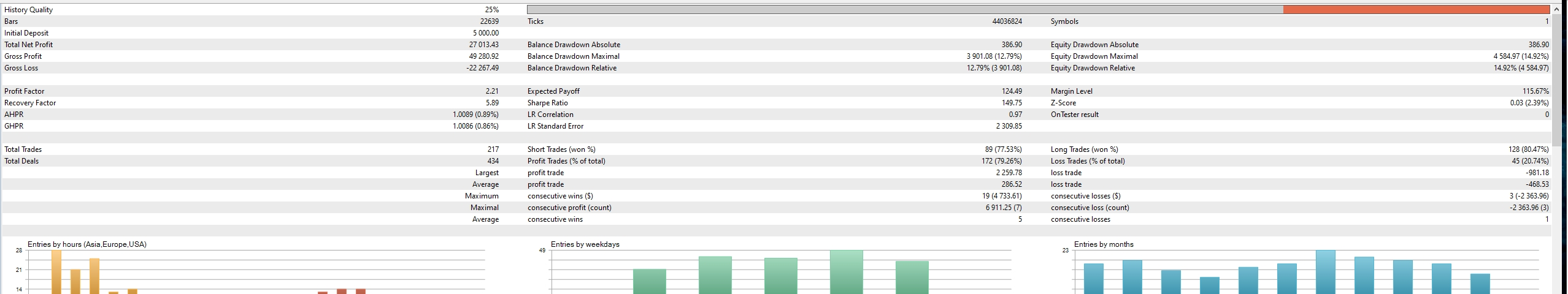

📊 2025 Performance Charts & Equity Graphs

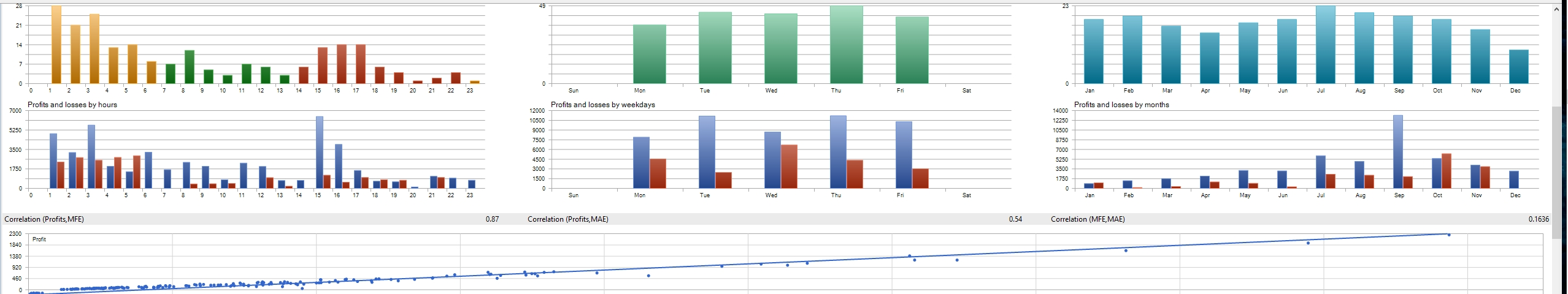

📊 2024–2025 Performance (Last 2 Years)

📊 2024–2025 Performance Charts & Equity Graphs

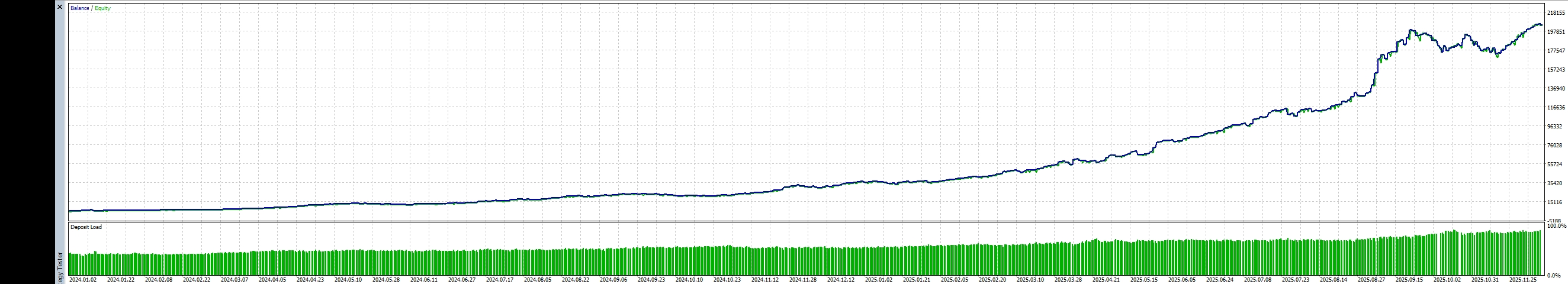

🏆 2021–2025 Performance (Last 5 Years)

🏆 2021–2025 Performance Charts & Equity Graphs

🧪 Backtesting Methodology (Transparency First)

To ensure realistic and repeatable results, all performance shown is tested under real-market conditions, not idealized environments.

✓ Modelling & Accuracy

- Modelling Mode: Every Tick based on Real Ticks (Accurately calculates spread, execution behavior, and tick flow)

- Why this matters: This mode reflects how orders are actually filled in live ECN environments, including spread expansion and micro price movement

✓ Execution & Latency

- Execution Delay: 100 ms

- Many VPS providers advertise 1 ms or 5 ms latency. In real trading conditions, true effective latency is often 50–100 ms due to broker routing, liquidity providers, network hops, and server load during volatility

- Testing with 100 ms delay produces results closer to real live performance, especially during news, volatile sessions, and market open/close hours

✓ Optimization Settings

- Optimization: ❌ Disabled

- Visual Mode: ✅ Enabled

- No curve-fitting. No parameter mining. Each test reflects a single, stable configuration

✓ Forward Testing & Leverage

- Forward Mode: ❌ Disabled

- Leverage Used: 1:50 or 1:100

- These leverage levels match real broker conditions and avoid unrealistic margin amplification

✓ Trading Costs Included

- ✅ ECN variable spreads (typically 5–15, expanding up to ~40 during market open/close)

- ✅ Commission: $7 per lot

- ✅ Realistic execution behavior

🚀 Small Account Growth Potential

💡 If You Follow the Creator's Guidance

Even small accounts will grow rapidly when proper risk management and recommended settings are followed. The combination of consistent win rates, adaptive ML risk control, and compounding growth can transform modest starting capital into substantial equity over time.

✨ Key Success Factors:

- Follow creator's recommended risk settings for your account size

- Allow the Smart ML engine to manage trades without interference

- Use proper lot sizing (dynamic % recommended for compounding)

- Maintain patience and let the system work 24×7

- Regular withdrawals after significant growth milestones

$5,000 - $11,000

$15,000 - $33,000

$25,000 - $55,000

*Estimates based on 300-1000% annual growth range with recommended settings. Past performance does not guarantee future results.

💰 Challenges Solved & Ideal Requirements

Problems This BOT Solves

- Emotional execution caused by fear, greed, or hesitation

- Overtrading and rule-breaking during losing streaks

- Manual execution errors and delayed trade entries

- Missed high-probability setups due to lack of 24×7 monitoring

Ideal Environment

- Reliable ECN broker infrastructure to support automated trading

- Stable VPS environment for uninterrupted 24×7 operation

- Low-latency execution to minimize slippage impact

- Avoid manual interruption while the bot is trading

🌍 News & Market Conditions

Designed to run 24×7

No need to disable during:

- High-impact (red folder) news

- Global events

- Extreme volatility

The ML engine automatically adapts risk and execution behavior.

🌐 Beyond One EA — Long-Term Algorithmic Ecosystem

GOLD Aggressive ML EA is not a standalone product. It is the foundation of a long-term, multi-market algorithmic ecosystem being developed with strict quality control, controlled distribution, and strategy protection.

🚀 Upcoming Trading BOTS

• Focus on drawdown control, rule compliance & consistency

• Suitable for FTMO / MyFundedFX / The5%ERS etc

• Focus on controlled risk & volatility timing

• Designed for intraday/Weekly movements

• Focus on theta decay + volatility contraction

• Designed for intraday Hedging

• Designed for professional-grade execution and Management

• Hybrid mode for Futures Propfirms included

• Designed for Option traders

• Under specific Risk management and DD control

Long-Term Vision:

To build a multi-asset, multi-market algorithmic ecosystem — not isolated bots — with shared intelligence, shared risk models, and continuous evolution.

🔐 Lifetime Access Model (Strictly Limited)

Why Lifetime Access Is Limited

Strategy edge, execution quality, and long-term survivability require a controlled user base. Mass selling destroys real algorithmic Strategic Edge.

- Lifetime users receive ALL future developments

- No additional payment for core algorithmic systems

- Priority access to new research & strategies

- Direct continuity with the creator

Lifetime Slot Allocation:

• First 25 users → 100% FREE Lifetime Access (includes all upcoming bots)

• Users 26–50 → 75% Discount (includes all upcoming releases)

• Users 51–75 → 62% Discount (includes all upcoming releases)

• Users 76–100 → 50% Discount (includes all upcoming releases)

After 100 lifetime subscribers — no lifetime licenses will ever be issued.

❓ Frequently Asked Questions

1️⃣ Pure Mathematics (Core Strategy)

• Entirely math-based strategy logic

• No discretionary rules, no visual interpretation

2️⃣ Smart Machine Learning (Dynamic Risk Management)

• Actively manages risk after trade entry

• Dynamically reduces exposure based on live market behavior

• Protects equity during unstable and extreme conditions

3️⃣ Market Dynamics (Creator's 14 Years of Trading Experience)

• Built from real trading experience across multiple market cycles

• Designed to handle abnormal, irrational, and manipulated markets

➡️ The EA reacts to market behavior, not trader opinions.

• Indicators (MA, RSI, MACD, Bands, Oscillators, etc.)

• Buy / Sell signals

• Candle patterns

• Price Action concepts

• SMC / ICT concepts

• BB, OB, FVG

• Chart patterns (Triangles, Wedges, Trendlines, Flags, Pennants, etc.)

The system is completely independent of all retail trading frameworks.

• No candle close confirmation required

• Execution logic is continuous and adaptive

• High-impact (red folder) news

• Extreme volatility

• Market open / close conditions

Risk and exposure are automatically adjusted by the ML engine.

• With full protection enabled: ~80%

• The reduction is intentional to improve capital safety and drawdown control.

• Risk is dynamically reduced immediately after entry

• Full 10% loss is extremely rare

• Thoroughly Tested with 20% risks normally without huge DD, so 10% is very safe

• Refer to Balance Drawdown Maximal in backtest results

Historically, full SL events almost never occur.

• Possible: $200 – $500 safely

• Recommended: $1000+ for smoother performance

• 3-Month Subscription

• 6-Month Subscription

• 12-Month Subscription

• Lifetime License

• The model will be considered based on demand and serious enquiries

• If we receive sufficient interest, it will be launched as soon as possible (ASAP)

• You can share your interest and opinion through the application form below

• Applicants who express interest through the application form will be notified immediately once this model is launched

• Risk percentage

• Lot sizing (fixed or dynamic)

• Account-specific optimization

📂 EA Performance Statistics & Equity Graphs

Detailed performance graphs, equity curves, and trade statistics (monthly, weekly, and daily) are available via Google Drive.

👉 Click here to view:

View Performance Charts & Stats (Google Drive)(Link opens in browser. If the link does not work for any reason, please scan the QR code below.)

📱 Scan QR Code for Performance Data

Scan to view EA performance statistics

📧 Contact Us

Demo for serious traders only.

📝 Early Access Application

⚠️ Only serious people fill the form and let us know about you.

Time passers please stay away.

This is an application process to identify genuine and serious traders, who ensure responsible participation. The goal is to onboard serious traders who align with the long-term vision

⚠️ Mandatory Legal Notice

By applying, you agree to our Privacy Policy